The budget has revised the tax slabs in the new tax regime to enhance its appeal to taxpayers

Representational Image. Pic/Pixabay

Let’s explore the tax changes and their impact on your personal finances.

ADVERTISEMENT

Changes in your tax slab:

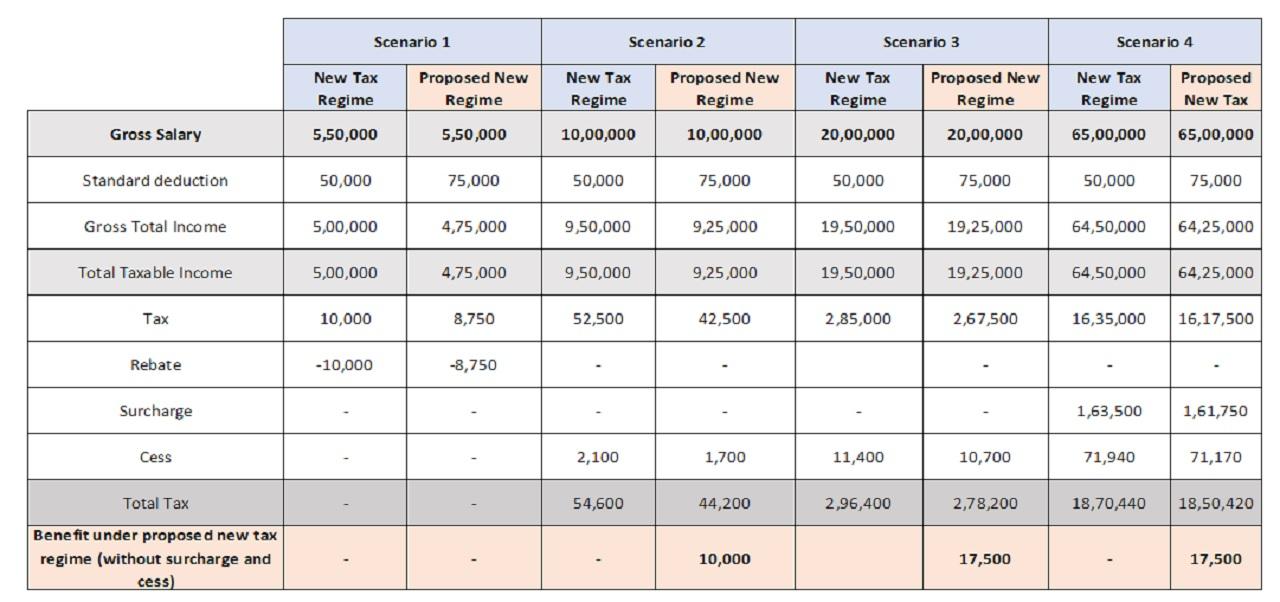

The budget has revised the tax slabs in the new tax regime to enhance its appeal to taxpayers. The standard deduction is proposed to increase from Rs 50,000 to Rs 75,000 under this regime. These changes could enable salaried employees to save up to Rs 17,500 in income tax.

Let me explain:

Enhanced deduction for family pension: For pensioners, the deduction on family pension is proposed to be increased from Rs 15,000 to Rs 25,000. This enhancement will relieve those who receive a family pension, ensuring better post-retirement financial stability.

No changes in the old tax regime: While the new tax regime received several updates, there were no announcements of changes in the old tax regime. Taxpayers who prefer the old system, which includes various exemptions and deductions, will not see any changes in their tax liabilities based on the Budget 2024.

What Budget Memorandum says simplification of capital gains:

The Budget 2024 has eliminated the indexation benefit for property sales, impacting how capital gains are calculated. Previously, the seller could adjust their purchase price for inflation, effectively lowering their taxable capital gains. Under the previous system, long-term capital gains (LTCG) from property sales were taxed at 20% with this indexation benefit.

As outlined in the new Budget, the LTCG tax rate has been reduced to 12.5%, but without the indexation benefit. This means that sellers can no longer adjust their purchase price for inflation to lower their capital gains tax.

Here is an example to illustrate this change:

Example:

Mr. A bought a property for Rs 50 lakh in FY 2004-2005. He sells the property in FY 2023-2024 for Rs 1.5 crore. Under the previous rules, the purchase price of Rs 50 lakh would be adjusted for inflation using the Cost Inflation Index (CII) numbers provided by the Income Tax Department. However, under the new rules, there will be no adjustment for inflation. The capital gains will be calculated by directly subtracting the purchase price from the sale price. Although the good news is that the LTCG tax rate has been reduced from 20% to 12.5%, the lack of indexation requires careful calculation to determine the actual tax impact.

The objective behind this is to simplify capital gains taxation by reducing the LTCG tax rate to 12.5% and removing the indexation benefit. This change is intended to make capital gains calculations easier for both taxpayers and tax authorities.

Impact on Real Estate Investors

The removal of indexation benefits is a significant issue for long-term real estate investors. Without this adjustment, taxable capital gains are expected to increase, raising the tax burden on property sales. This could reduce net profits and may deter investment in real estate, particularly for those who have held properties long-term where inflation is more impactful.

Multiple House Property Taxation

Multiple Properties and Short-Term Rentals: Tax relief now allows individuals to treat up to two properties as self-occupied. This update is beneficial for those with multiple homes or renting out properties short-term through platforms like Airbnb.

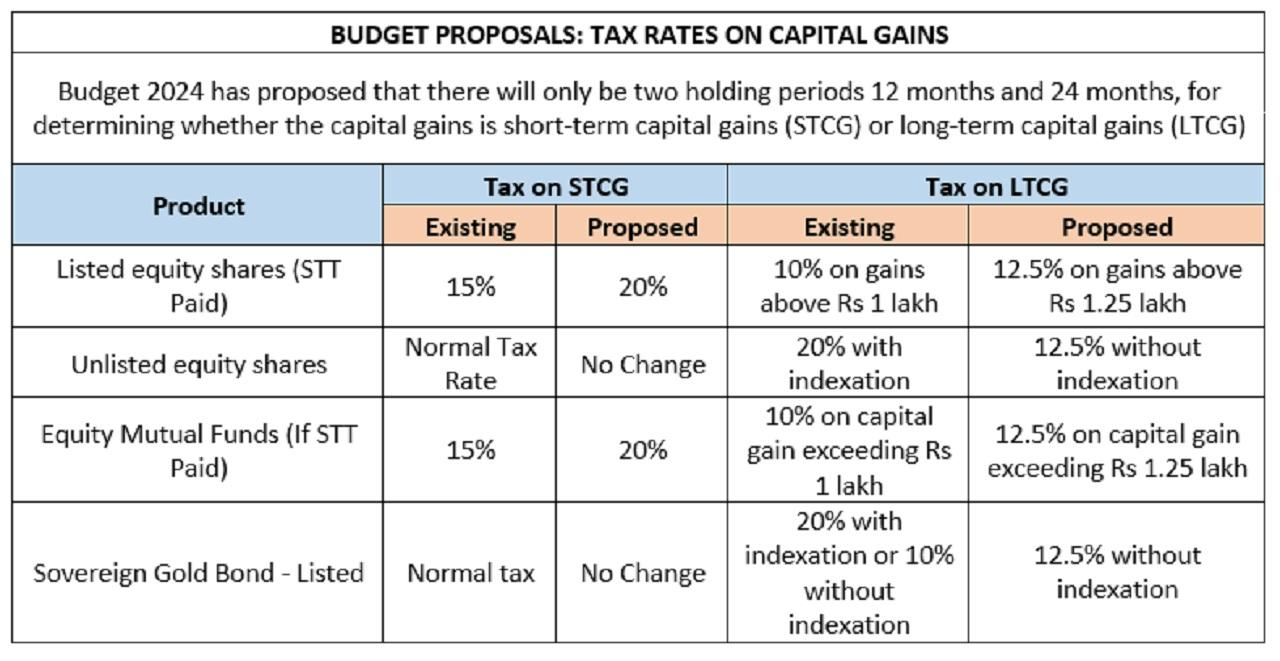

Long-Term Capital Gains Tax Raised from 10% to 12.5%

The long-term capital gains tax (LTCG) on all financial and non-financial assets has been increased to 12.5% from 10%. Short-term capital gains tax (STCG) on certain assets will now be 20%. Additionally, the exemption limit for LTCG has been raised to Rs 1.25 lakh from Rs 1 lakh. The budget also specifies that listed financial assets held for more than a year will be considered long-term.

Short-term gains on specific financial assets will be taxed at 20%, while gains on all other financial and non-financial assets will remain subject to their respective tax rates.

Listed financial assets held for over a year will be considered long-term, while unlisted financial assets and non-financial assets must be held for at least two years to qualify as long-term. Unlisted bonds, debentures, debt mutual funds, and market-linked debentures will be taxed on capital gains at the applicable rates, regardless of the holding period.

In my view, such changes may shake confidence and raise concerns about future tax hikes, but it's important to remember that equity gains might eventually offset some of these taxes because equity mutual funds remain an attractive investment opportunity compared to other asset classes. As I always say, "Death and taxes are certain," so focusing on increasing income and controlling what you can is crucial.

Increased STT on F&O in Budget 2024

In a major setback for Futures and Options (F&O) traders, the Security Transaction Tax (STT) rate has been increased from 0.01% to 0.02%. Consequently, equity and index traders will face double the tax on their trades under this new budget proposal.

NPS Tax Deduction Increase

Enhanced Deduction: The tax deduction for employer contributions to the New Pension Scheme (NPS) is set to rise from 10% to 14%. This benefit will now extend to both public and private sector employees, aligning with the current benefits enjoyed by government employees.

Introducing NPS Vatsalya for Minors

Budget 2024 introduces the NPS Vatsalya for minors, which will convert to a standard NPS when the child turns 18.

NPS Vatsalya is a scheme where parents or guardians can contribute to a minor's account, which converts into a regular NPS plan when the child turns 18.

“This initiative helps build early financial discipline by allowing parents to start saving for their child’s future, with a smooth transition to a standard NPS plan upon reaching adulthood.”

Buyback will be taxable in the hands of the shareholder

Buybacks will now be taxed as dividend income. This change, effective from October 1, will diminish the attractiveness of buybacks for investors.

Foreign Assets Reporting

Relaxed Penalties: The budget has proposed easing penalties for not reporting overseas assets up to Rs 20 lakh in tax returns. This aims to relieve small taxpayers who might have overlooked foreign asset reporting.

TCS and TDS Adjustments

Salaried Individuals’ Relief: Starting October 1, salaried employees will benefit from reduced TDS as they can declare TCS to their employers. This change will ease cash-flow issues and adjust any due refunds directly against TDS.

(Rishabh is a chartered accountant and a renowned personal finance expert in India. He advises chairmen, founders, HNIs, CEOs, and top executives on investments and wealth management. He is the founder of NRP Capitals, that manages and distributes financial products for hundreds of clients)

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!